Oil is back

Oil is one of the key commodities which influences daily life to a large extent There is no alternative available at the same price point, ease of availability, or installed infrastructure to make it available easily. Therefore, replacing oil will take decades, in fact as of today we have not moved out of coal which is much worse than oil.

Oil is profound with its impact on the following sectors:

(i) transportation – commercial / personal

(ii) Electricity generation

(iii) Petrochemical – feedstock is naphtha a byproduct of the oil refinery

The above sectors are fundamental in today’s modern life and it is unthinkable without these.

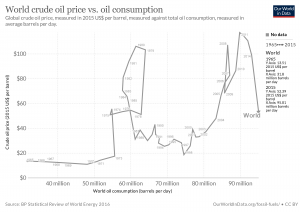

Below graph (courtesy Ourworldindata.org) shows a clear picture of the crude oil consumption and price of the oil

The gyrations are vigorous after the year 2000 and it still continues.

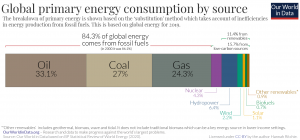

Progress of human beings is measured by the energy it consumes. The source of energy tells us the story of fossil fuel domination even today. The below table vividly depicts our dependency on coal (solid – high polluting), oil (liquid – polluting), and gas (less polluting). Fossil fuel dependency makes up a staggering 84.2% of the total energy consumption.

The above graph demonstrates our status as of today and we don’t feel that there is any magic wand (technology or fuel etc.) available till now which will replace these overnight as the infrastructure cost etc. are going to be high for any new source to dominate. The % consumption will only gradually reduce even though there may be radical newspaper headlines, climate conferences, etc.

The bottom line of this is that the world will “rely” on fossil fuels in the near future (two decades or more) even though we don’t like them.

The latest oil price slump in March 2020 was due to the Coronavirus spread and subsequent government intervention to restrict travel, business to limit people contact to reduce the spread and its devastating impact on health infrastructure.

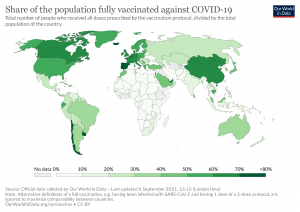

However, with the advent of various vaccines and their approval from late 2020, the vaccine rollout has been going on. The below world map (courtesy Ourworldindata.org) shows the vaccine rollout as of August 2021, which indicates the Americas, EU is doing well in terms of % of full vaccination.

Based on the optimism, the oil price is climbing from negative in April 2020 to around $72 per barrel which is considered to be a “sweet” spot for producers and consumers.

Role of OPEC+ in Oil Price

The cartelization of supply has a long history from the time when oil was discovered in America due to necessity. As this commodity cannot be stored indefinitely, therefore, the price gyrates vigorously depending on the supply and demand dynamics.

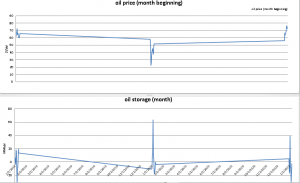

The price of oil has a profound impact on the economics of both supply and demand-side therefore a stable price within a band is the most sought-after objective. This was the backdrop OPEC was born in the 1960s with major suppliers in the Middle East, South America, Africa. They included Russia in 2020 to become OPEC+ and have achieved a stability from the bottoms of April 2020. The oil price is steady in a band of $60 – $75 for most of 2021 and is expected to be stable as OPEC+ has shown discipline with their quota.

It is envisaged OPEC+ will continue to play its role in coming years to pacify oil prices within a band to promote a stable economy for the supplier and consumer countries to come out of COVID-induced slowdown.

The above graph clearly shows the recovery of oil price from April 2020 and the storage levels are reducing at a steady rate which is a positive sign for oil to be in a stable zone.

“Future” of Oil

For the world to grow it is understood energy is required for mobility, food, warmth, communication and a zillion things. Therefore, going forward the oil’s future is dependant on how fast a/more alternatives are developed which will be competitive, widely acceptable, easily available, and safe. For this to happen it can be safely predicted it would take a minimum of another couple of decades for the alternatives to come close to the rank oil/gas monopoly in the energy mix.

The more prudent approach would be to use oil/gas in a sustainable way than to replace it completely as the cost of replacement would cripple many of the advanced / developing economies leading to economic catastrophe. So, oil’s future looks to be one of certain and here to “stay” for a certain foreseeable future, say, two-three decades before it probably declines gradually.